Absolutely! Here’s a comprehensive 2900-word article about business food allowances, incorporating your requested formatting changes.

In the dynamic world of business, where deals are forged over lunch and networking happens at dinner, food expenses are an inevitable part of the landscape. However, managing these costs efficiently and compliantly requires a nuanced understanding of food allowances. This article delves into the intricacies of business food allowances, exploring their purpose, types, regulations, and best practices.

Food allowances serve several critical functions within a business context:

Facilitating Business Relationships

Food allowances play a crucial role in building and maintaining relationships with clients, partners, and colleagues. Sharing a meal provides an informal setting for discussions, fostering rapport and strengthening professional bonds.

Supporting Employee Morale and Productivity

Providing meals or allowances for employees during business trips or long working hours can boost morale and productivity. It demonstrates care for employee well-being and helps sustain energy levels.

Representing the Company Professionally

When hosting clients or attending industry events, food allowances enable businesses to present a professional image. The quality and presentation of meals reflect the company’s standards and values.

:max_bytes(150000):strip_icc()/deducting-business-meals-and-entertainment-expenses-398956-Final-edit-9a8310ac2d5f422c87530d3d085e45d6.jpg)

Food allowances can take various forms, each tailored to specific business needs and circumstances.

Per Diem Allowances

Per diem allowances provide a fixed daily amount to cover food expenses during business travel. This simplifies expense tracking and allows employees flexibility in choosing meals.

Meal Reimbursements

Meal reimbursements involve employees submitting receipts for actual meal expenses, which are then reimbursed by the company. This method offers precise tracking but requires detailed record-keeping.

Company-Provided Meals

Some companies provide meals directly, such as catered lunches for meetings or on-site cafeterias. This eliminates the need for individual allowances or reimbursements.

Entertainment Allowances

Entertainment allowances cover meals and other related expenses incurred while entertaining clients or business partners. These allowances are often subject to specific regulations and limitations.

Food allowances are subject to various tax and regulatory considerations, which can vary by jurisdiction.

Tax Deductibility

In many countries, businesses can deduct a portion of food expenses as business expenses. However, there are often limitations and specific requirements for documentation.

Reasonableness and Necessity

Tax authorities typically require that food expenses be “reasonable and necessary” for business purposes. Extravagant or personal meals may not be deductible.

Documentation Requirements

Accurate record-keeping is crucial for supporting food expense claims. This includes detailed receipts, dates, locations, and the business purpose of the meals.

Reporting and Compliance

Businesses must comply with relevant tax reporting requirements, including accurately reporting food expenses and allowances.

Effective management of food allowances requires a strategic approach that balances cost control, employee satisfaction, and regulatory compliance.

Establish Clear Policies

Develop clear and comprehensive policies that outline food allowance guidelines, including eligible expenses, reimbursement procedures, and documentation requirements.

Set Reasonable Limits

Establish reasonable limits on food allowances to control costs and prevent abuse. Consider factors such as location, meal type, and business purpose.

Use Technology for Expense Tracking

Utilize expense management software or mobile apps to streamline expense tracking, automate reporting, and ensure compliance.

Provide Training and Guidance

Educate employees on food allowance policies and procedures, including how to properly document expenses and comply with regulations.

Regularly Review and Update Policies

Periodically review and update food allowance policies to reflect changes in business needs, regulations, and industry best practices.

Food allowances can be influenced by location and cultural norms.

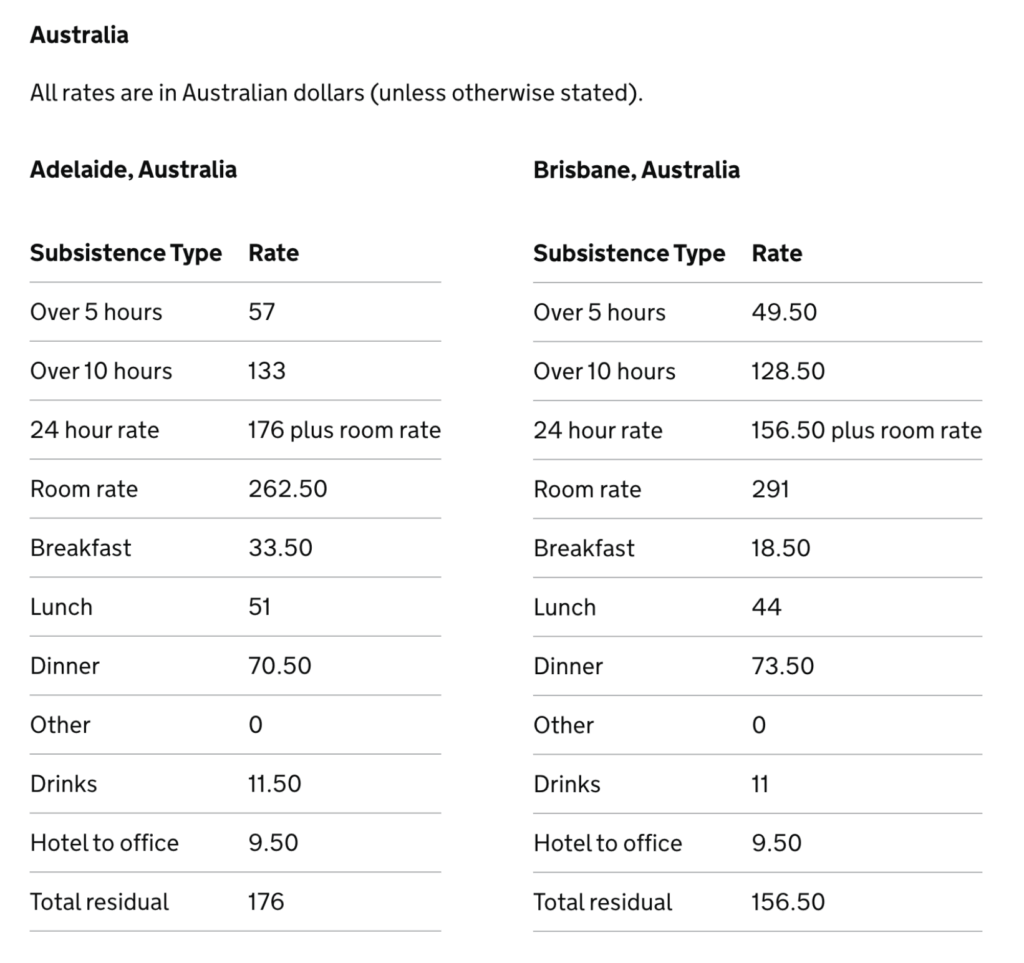

Regional Cost of Living

The cost of food varies significantly across different regions. Food allowances should be adjusted accordingly to reflect local prices.

Cultural Dining Customs

Different cultures have varying dining customs and expectations. Businesses should be sensitive to these differences when setting food allowance policies.

International Travel Considerations

When traveling internationally, businesses must consider exchange rates, local cuisine, and cultural nuances related to dining.

Food allowances can significantly impact employee satisfaction and morale.

Perceived Value

Employees often perceive food allowances as a valuable benefit, particularly during business travel or long working hours.

Flexibility and Choice

Providing employees with flexibility in choosing meals can enhance satisfaction and accommodate dietary preferences.

Fairness and Consistency

Ensuring fairness and consistency in food allowance policies is crucial for maintaining employee trust and morale.

Businesses are increasingly considering sustainable practices when managing food allowances.

Reducing Food Waste

Encouraging employees to minimize food waste can contribute to environmental sustainability.

Supporting Local and Sustainable Restaurants

Choosing restaurants that prioritize local and sustainable ingredients can align with corporate social responsibility goals.

Promoting Healthy Eating Habits

Providing healthy meal options and encouraging balanced diets can promote employee well-being.

The future of food allowances is likely to be shaped by technological advancements, evolving regulations, and changing business practices.

digitalization and Automation

Digital tools and automation will continue to streamline expense tracking and management.

Increased Focus on Compliance

Regulatory scrutiny of food expenses is likely to increase, requiring businesses to maintain meticulous records.

Emphasis on Employee Well-being

Businesses will increasingly prioritize employee well-being, including providing healthy and sustainable meal options.

Business food allowances are a critical aspect of managing expenses and fostering business relationships. By understanding the purpose, types, regulations, and best practices, businesses can effectively navigate the culinary costs of commerce. Clear policies, reasonable limits, and meticulous record-keeping are essential for ensuring compliance and maximizing the benefits of food allowances. As the business landscape evolves, businesses must adapt their food allowance strategies to reflect changing regulations, technological advancements, and the growing emphasis on employee well-being and sustainability. Ultimately, well-managed food allowances can contribute to a company’s professional image, employee satisfaction, and overall success.